Popular Topics

- AI/ML

- All About Universities

- Australia

- Canada

- Data Science / Analytics

- Denmark

- Dubai

- Environmental / Sustainability

- Finland

- France

- Germany

- Ireland

- Latest News

- Malaysia

- MBA/ Business

- Middle East

- New Zealand

- Poland

- Post Study & PR

- Program Selection

- Qatar

- Saudi Arabia

- Scholarships

- Spain

- STEM / Engineering

- Student Visa

- Study Destination

- Study Options By Subject

- Sweden

- Tests & Grades

- Thailand

- The Netherlands

- Travel, Stay, Culture Training

- UAE

- UK

- USA

How to Open Bank Account in Ireland as Indian Students

- June 12, 2025

Moving to Ireland as an international student? One of the first things you’ll want to do upon arrival is open a local bank account. It will make your life much easier – from paying rent and receiving part-time wages, to avoiding international transaction fees. Today, let’s discuss how to open a Bank Account in Ireland as an Indian Student.

Why Do International Students Need an Irish Bank Account?

While you can use your home country’s debit/credit card initially, having a local bank account helps with:

- Avoiding high currency conversion and withdrawal fees

- Receiving payments from part-time jobs or scholarships

- Paying local bills (e.g., rent, phone, utilities)

- Establishing financial credibility in Ireland

When Should You Open Your Bank Account?

Ideally, within the first few weeks of arrival. Some universities even have tie-ups with local banks and help you set up an account during orientation.

Types of Bank Accounts for Students

There are generally two types:

1. Student Current Account

- For daily use (debit card, ATM, online banking)

- Usually fee-free for full-time students

2. Basic Bank Account

- For students who might not have proof of address yet

- Comes with limited features (no overdraft)

Documents Required to Open a Bank Account in Ireland

Here’s what you typically need:

| Document Type | Examples |

|---|---|

| Valid Passport | Passport with student visa stamp |

| Proof of Address (Ireland) | Utility bill, tenancy agreement, or a letter from your university |

| Proof of Student Status | Student ID card, acceptance letter, or enrollment letter from your university |

| GNIB/IRP Card (optional but helpful) | Irish Residence Permit issued post arrival |

Also, note that some banks accept university letters addressed directly to the bank as valid proof of address.

Top Banks for International Students in Ireland

| Bank Name | Account Name | Key Benefits |

|---|---|---|

| Bank of Ireland | 3rd Level Student Account | No fees, mobile banking, student overdraft |

| Allied Irish Banks (AIB) | Student Plus Account | Free contactless debit card, mobile app, overdraft |

| Permanent TSB | Student Account | No maintenance fee, budgeting tools |

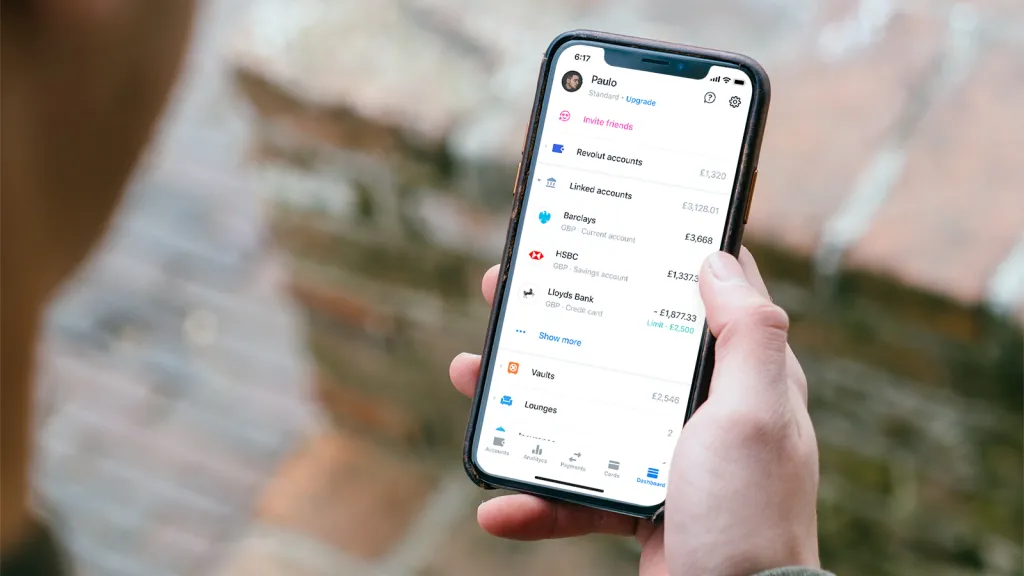

| Revolut (Online) | Standard/Student Account | Quick setup, virtual cards, currency exchange |

| N26 (Online, EU licensed) | N26 Standard | Great for digital-first students |

Steps to Open a Bank Account in Ireland

- Choose Your Bank

Compare benefits, branch access, and online services. - Gather Your Documents

Ensure you have originals + photocopies if required. - Make an Appointment (if needed)

Some banks allow walk-ins, but it’s safer to book in advance. - Visit the Bank in Person

Most banks require a physical visit for verification. - Wait for Account Activation

It typically takes 2–5 business days. You’ll receive your debit card by post.

Can You Open a Bank Account Online?

Yes – Revolut and N26 offer fully digital accounts, which can be set up using just your passport and selfie video. However, these aren’t accepted by all institutions for rent payments or official purposes, so having a traditional bank account is still recommended.

Tips for Managing Your Irish Bank Account

- Use online banking apps for convenience.

- Avoid overdraft usage unless it’s free for students.

- Keep your PIN secure and report card loss immediately.

- Use ATMs from your own bank to avoid withdrawal charges.

You Might Also Like: Health and Safety in Ireland For Indian Students

Need Personalized Help Navigating Life in Ireland?

At Admitix, we not only guide you through your study abroad journey – from admissions to visa – but also help you settle in with ease, including housing, SIM cards, and more.

Reach out to us today for a personalized pre-departure checklist and an Ireland student survival guide!

FAQs – Open a Bank Account in Ireland as Indian Students

Can I open a student bank account in Ireland without a GNIB/IRP card?

Yes, most banks accept your passport and university letter as sufficient ID initially.

Is a PAN card or Aadhaar required to open a bank account in Ireland?

No, Indian government IDs are not required – only Irish and passport documents matter.

Will my Indian debit card work in Ireland until I open a local account?

Yes, but international transaction fees and currency conversion charges will apply.

Can I use my Indian address as proof of address in Ireland?

No, you need an Irish address – your tenancy agreement or university accommodation letter works.

Which Irish bank is easiest for international students to open an account with?

Bank of Ireland and AIB are both student-friendly and commonly used by Indian students.

Can I open an Irish bank account from India before traveling?

No, traditional banks require in-person verification after arrival.

Do Irish student accounts come with international money transfer options?

Yes, most accounts allow transfers to and from India, though fees may apply.

Is it mandatory to open a bank account in Ireland to receive part-time job payments?

Yes, employers usually require an Irish account for salary deposits.

Will I get a physical debit card immediately after opening the account?

No, it’s usually mailed to your Irish address within 3–5 working days.

Can I keep my Irish student account after graduation?

Yes, but it may convert to a regular account with monthly maintenance fees.